CDP Hedger

Protect your collateral against unexpected events with put options.

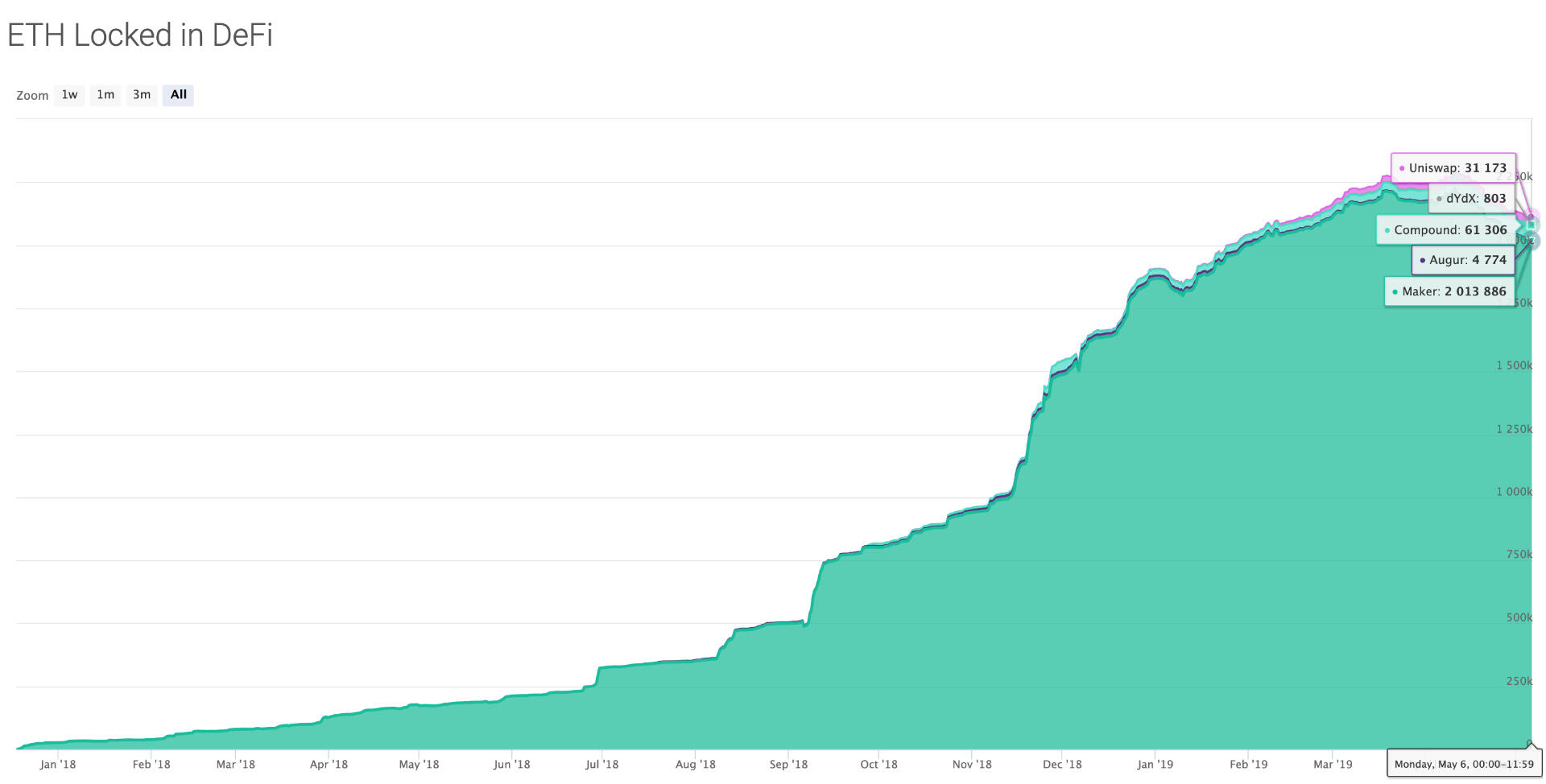

The Rise of #DeFi

Recent demand for CDPs resulted in over $500 million worth of Ethereum locked up as collateral.

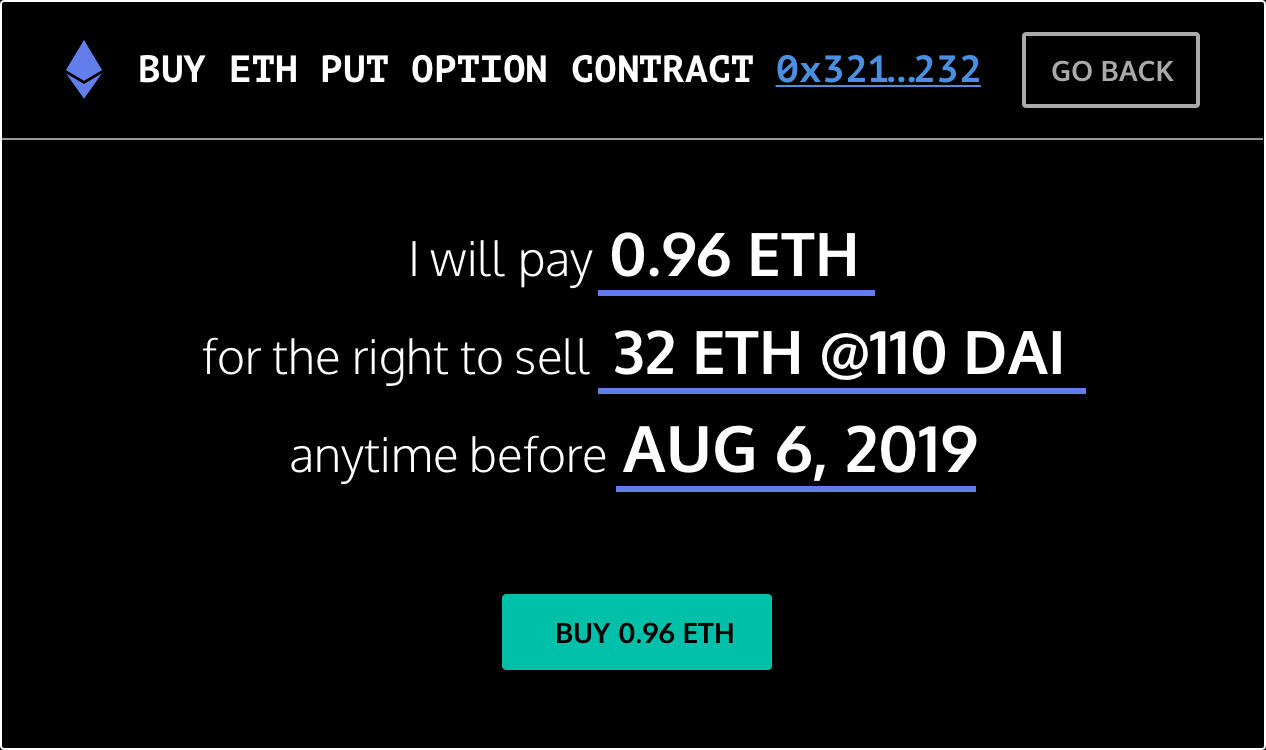

The Need to Hedge

The volatility of the cryptocurrency market & an increasing number of collateralized assets facing possible liquidations implies significant demand for risk optimizing tools.

How to protect your collateral:

Enter your desired cover amount, liquidation price, and cover period to view your premium rate.

Send required premium amount to purchase put option contracts.

If you get liquidated, put option underwriters cover your losses.

How to earn premium fees for underwriting put options with Hedger:

Supply DAI to selected Strike/Expiration Put Option Contract Combination Pool.

Receive premium when buyers mint Put Option Tokens.

Minted portion of supplied assets are locked until exercised or expired.

Get early access

Thanks for signing up!

We will reach out shortly.